Hello, and welcome to my Fry’s Investment Report review.

Fry’s Investment Report is a stock advisory run by Eric Fry of InvestorPlace that claims to help you profit from “big picture” trends in the market.

Eric Fry’s sales presentations are usually quite convincing. He always seems to know about an exciting new stock that can make us big money.

But the “stock picking” industry is rife with scams and shams…

So it’s a great thing you’re here doing your due diligence before joining.

And I’ve found that the best way to determine if something is a scam or not is to look for the red flags, as these can be signs that you are about to be scammed.

I want to walk you through these in detail. I also want to give you the heads-up about my top-rated newsletter service, as it is (hands down) the best and most ethical in the industry. But first, let’s discuss the things you really need to look out for in the world of stock advisories.

See My Top RecommendationFry’s Investment Report Review: 6 Things to Know Before Joining (Red Flags)

I’ve reviewed 100s of stock-picking services over the years, and in that time, I’ve learned that there are a handful of red flags to watch out for.

Knowing these can help you avoid scams and find legitimate services that (actually) help you outperform the market and secure your financial future.

(1) Companies That Make “Get Rich Quick” Claims

One of the most common signs of a newsletter scam is sensationalist claims about how you can make big money in a short period of time following the stock picker’s recommendations.

Anything is possible in the stock market, but overhyped marketing is a dead giveaway that you are dealing with a shady service because legitimate companies don’t do this. Instead, they share their (actual) research with you to help you understand their thesis.

In the end, if you think the presentation is using sensationalist marketing hype rather than sharing genuine investment research with you, think twice before joining it.

What does the company claim? Many of the Fry’s Investment Report presentations highlight opportunities in “little-known” stocks with big potential. While it’s true that lesser-known companies can sometimes deliver outsized returns, it’s important to approach these kinds of claims with a balanced perspective and do your own research.

(2) Companies That Don’t Have a Proven Track Record

The best stock advisories have a proven track record of success because what they recommend has worked and has helped their subscribers grow their wealth.

In contrast, low-quality newsletter services don’t show you how well the service has performed because they know their picks haven’t worked out.

Some companies even hide their track records in the newsletter archives, where no one looks, which makes it virtually impossible to verify their complete track record.

If the company isn’t upfront about how it has performed… it’s probably one to avoid.

Does Fry’s Investment Report have a proven track record? The Fry’s Investment Report website doesn’t provide a full track record of past recommendations. Instead, it highlights a few standout winners without offering much context about the overall performance, including losing picks.

For instance, Eric Fry recommended a company called Stem in 2023 when it was trading around $10 per share, which has since dropped to about 50 cents.

To be fair, he has made some strong calls over the years. But the lack of transparency around the service’s full performance history makes it difficult to evaluate the track record objectively.

(3) Companies That Don’t Clearly Outline Their Pricing

Another thing to watch out for is companies with shady pricing policies.

For instance, some companies sell their service at a low price for the first 12 months, but then it automatically renews at a higher price after that, which isn’t properly disclosed.

If a company tries to charge you hidden fees and isn’t upfront about their pricing, that is a red flag and a warning sign to avoid getting involved with them.

How much does Fry’s Investment Report cost? Fry’s Investment Report costs $499/year, depending on which page of the company website you join through. However, there is an upsell pitched to subscribers called The Speculator, which costs $3,000/year, and the company pitches subscribers on $10,000s in additional services they sell.

(4) Companies With Shady Refund Policies

Unethical stock advisory companies do not have clear, transparent refund policies in place for their services, which is another red flag to watch out for.

For example, some companies lead you to think they provide a money-back guarantee in the sales copy, but if you ever try to get your money back, you find out that all they really offer is a “credit refund.” What this means is that you can only get a ‘credit’ to use toward buying another one of their services. This is highly unethical because it means you can never truly get your money back.

Bottom line… genuine stock advisory companies provide genuine money-back guarantees on their services because they know what they’re offering provides real value. So if the company you are researching has a shady refund policy in place, it may be one to avoid.

Does Fry’s Investment Report have a good refund policy? It’s not possible to get your money back if you’re unhappy with Fry’s Investment Report. If you request a refund, the company will only provide you with a credit to use toward purchasing another newsletter they sell.

(5) Companies With a Bad Reputation

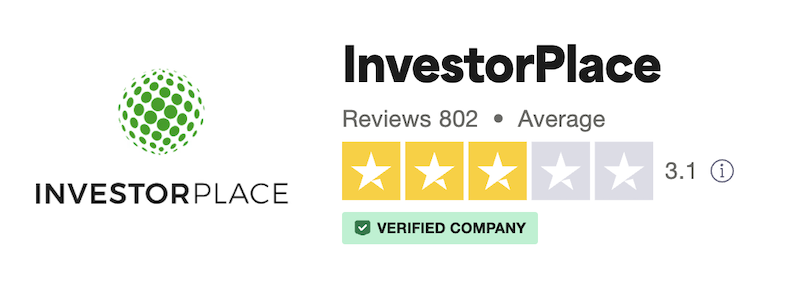

One thing I always do when researching a newsletter service is check the company’s TrustPilot rating, as this is one of the best places to go to find genuine customer reviews. If a company doesn’t have a TrustPilot profile or is rated below 4 stars, there are likely better alternatives to consider.

What is the company’s TrustPilot rating? The company behind Fry’s Investment Report, InvestorPlace, currently has a 3.1-star rating on TrustPilot:

(6) Is Fry’s Investment Report Legit?

Yes, Fry’s Investment Report is a legitimate service. It’s not a scam, and Eric Fry has recommended some great stocks over the years.

That said, it’s not my top recommendation.

There’s often a lot of “get rich quick” hype in Eric Fry’s marketing, and I’m not convinced that his actual track record lives up to those bold claims.

So while it may be worth a look, I wouldn’t recommend it — especially when there are far better options available.

For example: Alexander Green.

I’ve reviewed hundreds of investment newsletters over the years, and few have impressed me as much as Alex Green’s track record.

He has called more triple-digit (and even quadruple-digit) stock winners than anyone I’ve seen. In fact, Alex identified 4 of the 6 best-performing stocks of the past 20 years — Apple, Netflix, Intuitive Surgical, and Nvidia.

That’s not just impressive — it’s nearly unheard of.

Now, Alex is zeroing in on what he sees as the biggest investment opportunity for 2025: artificial intelligence.

He believes AI is about to reshape the global economy, and that it could create 20 million new millionaires over the next four years as America races to lead the AI revolution.

In a brand-new presentation, Alex reveals his top 3 AI stocks for 2025 — and why each could soar as much as 20-fold or more in the years ahead.

He shares all the details in a special event alongside veteran broadcaster Bill O’Reilly.

Click here to watch the full presentation now:

Go Here to Watch the Presentation ►