Hello, and welcome to my review of Stansberry’s Investment Advisory.

Stansberry’s Investment Advisory is a monthly investment newsletter published by Stansberry Research and led by former hedge fund manager Whitney Tilson.

Tilson claims to help regular investors “make outstanding gains” in any market by identifying promising emerging trends and economic forces.

Sounds good…

But is it legit? Or just another newsletter filled with bold claims and marketing spin?

That’s exactly what I wanted to know. So I took a deep dive into Whitney Tilson’s Investment Advisory to see how it really stacks up — and whether it’s worth your time and money.

In this review, I’ll show you exactly what I found.

See My Top-Rated NewsletterStansberry’s Investment Advisory Review: 6 Things to Know Before Joining

I’ve reviewed 100s of stock-picking services over the years, and in that time, I’ve learned that there are a handful of red flags to watch out for.

Knowing these can help you avoid scams and find legitimate services that (actually) help you outperform the market and secure your financial future.

(1) Does the Company Make “Get Rich Quick” Claims?

One of the most common signs of a newsletter scam is sensationalist claims about how you can make big money in a short period of time following the stock picker’s recommendations.

Anything is possible in the stock market, but overhyped marketing is a dead giveaway that you are dealing with a shady service because legitimate companies don’t do this. Instead, they share their (actual) research with you to help you understand their thesis.

In the end, if you think the presentation is using sensationalist marketing hype rather than sharing genuine investment research with you, think twice before joining it.

What does the company claim? Stansberry’s Investment Advisory generally takes a more measured approach compared to some of the louder stock-picking services out there. You typically won’t see extreme “get rich overnight” promises plastered across their homepage.

And the main editor of the service, Whitney Tilson, is one of the more respected stock pickers in the industry. He’s founded his own hedge fund (and grew it to $200M), authored numerous books, appeared on different news networks, and started his own publishing company called Empire Financial Research (which, worth noting, is no longer operating).

I’ve analyzed many of his presentations over the years, too. And what I’ve found is that most of them are informative and share great ideas, but they can also be overhyped at times. So I think it’s important to approach his claims with a grain of salt.

(2) Does Stansberry’s Investment Advisory Have a Good Track Record?

The best stock advisories have a proven track record of success because what they recommend has worked and has helped their subscribers grow their wealth.

In contrast, low-quality newsletter services don’t show you how well the service has performed because they know their picks haven’t worked out.

Some companies even hide their track records in the newsletter archives, where no one looks, which makes it virtually impossible to verify their complete track record.

If the company isn’t upfront about how it has performed… it’s probably one to avoid.

Does Stansberry’s Investment Advisory have a good track record? Stansberry’s Investment Advisory has been around for over 20 years, and it has seen its share of ups and downs. But overall, it appears to have delivered fairly respectable long-term performance.

According to Stansberry Research, some of the most notable long-term picks in the Stansberry’s Investment Advisory portfolio include Microsoft (MSFT) and American Express (AXP), which are up by 1,317% and 419% respectively (as of February 2025).

However, more recent results under Whitney Tilson have been mixed.

In 2024, Tilson recommended 12 stocks to Stansberry’s Investment Advisory subscribers, which collectively returned just 3% on average.

It’s still too early to judge whether those picks will pay off over time, but the early results highlight the variance between the service’s legacy long-term winners and the shorter-term performance seen more recently.

(3) Are There Any Hidden Fees?

Another thing to watch out for is companies with shady pricing policies.

For instance, some companies sell their service at a low price for the first 12 months, but then it automatically renews at a higher price after that, which isn’t properly disclosed.

If a company tries to charge you hidden fees and isn’t upfront about their pricing, that is a red flag and a warning sign to avoid getting involved with them.

How much does Stansberry’s Investment Advisory cost? Stansberry’s Investment Advisory costs $499 per year to join, which comes with access to the monthly newsletter, a new stock idea each month, and access to the model portfolio.

There are also many higher-priced services (upsells) that the company pitches new members. So if you do join, be prepared for emails encouraging you to spend considerably more money. Collectively, there are $10,000s of additional services the company (and Tilson) runs.

(4) Is the Refund Policy Legitimate?

Unethical stock advisory companies do not have clear, transparent refund policies in place for their services, which is another red flag to watch out for.

For example, some companies lead you to think they provide a money-back guarantee in the sales copy, but if you ever try to get your money back, you find out that all they really offer is a “credit refund.” What this means is that you can only get a ‘credit’ to use toward buying another one of their services. This is highly unethical because it means you can never truly get your money back.

Bottom line… genuine stock advisory companies provide genuine money-back guarantees on their services because they know what they’re offering provides real value. So if the company you are researching has a shady refund policy in place, it may be one to avoid.

Does Stansberry’s Investment Advisory have a good refund policy? Stansberry’s Investment Advisory comes with a 30-day refund policy. However, most of the higher-priced services only offer a “Stansberry Credit” that you can use toward purchasing their other services.

(5) Does the Company Have a Good Reputation?

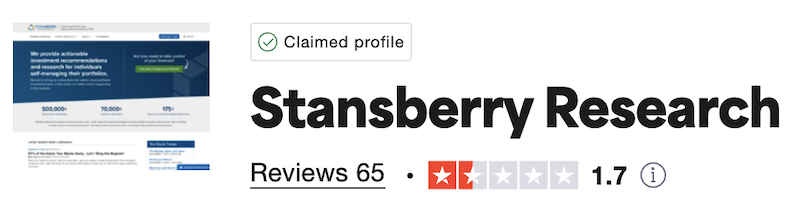

One thing I always do when researching a newsletter service is check the company’s TrustPilot rating, as this is one of the best places to go to find genuine customer reviews. If a company doesn’t have a TrustPilot profile or is rated below 4 stars, there are likely better alternatives to consider.

What is Stansberry’s Investment Advisory’s TrustPilot rating? The company behind Stansberry’s Investment Advisory, Stansberry Research, currently has a 1.7-star rating on TrustPilot:

That is quite a low TrustPilot rating. However, the rating appears to be less about the quality of the company’s services and more about its marketing tactics. Many have complained about receiving too many emails and the high pressure marketing tactics used to pitch the upsells.

(6) Is Stansberry’s Investment Advisory Legit?

Stansberry’s Investment Advisory isn’t a scam, it’s a legitimate service that provides subscribers with real research on stocks that Whitney Tilson believes have potential. And while not every stock the service has recommended has performed well, overall, it has a reasonable track record.

That said, it’s not my top recommendation.

There’s often a lot of sensationalism in the company’s marketing, and despite the bold claims, I’m not convinced that it’s the best service out there.

So while it may be worth a look, I wouldn’t recommend it — especially when there are far better options available.

For example: Alexander Green.

I’ve reviewed hundreds of investment newsletters over the years, and few have impressed me as much as Alex Green’s track record.

He has called more triple-digit (and even quadruple-digit) stock winners than anyone I’ve seen. In fact, Alex identified 4 of the 6 best-performing stocks of the past 20 years — Apple, Netflix, Intuitive Surgical, and Nvidia.

That’s not just impressive — it’s nearly unheard of.

Now, Alex is zeroing in on what he sees as the biggest investment opportunity for 2025: artificial intelligence.

He believes AI is about to reshape the global economy, and that it could create 20 million new millionaires over the next four years as America races to lead the AI revolution.

In a brand-new presentation, Alex reveals his top 3 AI stocks for 2025 — and why each could soar as much as 20-fold or more in the years ahead.

He shares all the details in a special event alongside veteran broadcaster Bill O’Reilly.

Click here to watch the full presentation now:

Go Here to Watch the Presentation ►