Hi, and welcome to my review of Motley Fool Stock Advisor.

Stock Advisor is the Motley Fool’s flagship stock-picking service, and with more than 1 million members, it’s easily one of the most popular investing newsletters in the U.S.

How has it performed?

Since launching in 2002, their picks have almost 6X’d the S&P 500. Some of the companies they’ve recommended include Amazon, Netflix, Disney, and Nvidia… well before they became household names. So they’ve recommended some great stocks over the years.

But is it still worthwhile today? And should you join?

That’s what I wanted to know. So I joined Stock Advisor myself and dug through the member’s area. And in this review, I’ll show you exactly what I found.

I’ll also introduce you to my top-rated newsletter, which is a no-hype service run by a guy who has called more triple-digit (and even quadruple-digit) stock winners than anyone I’ve seen.

See My Top-Rated NewsletterMotley Fool Stock Advisor Review (6 Things to Know Before Joining)

After going through everything Motley Fool Stock Advisor has to offer, I can confidently say it’s a high-quality service with a strong track record.

That said, it won’t be the right fit for everyone. So if you want to know how it works, who’s behind it, and whether it’s still worth joining today, keep reading.

(1) What Is Motley Fool Stock Advisor?

Motley Fool Stock Advisor is the flagship stock-picking newsletter from The Motley Fool, and it was founded in 1993 by brothers David and Tom Gardner.

The service itself was launched in 2002, and now has over half a million members, making it one of the most popular investing services in the U.S.

Stock Advisor was built for long-term investors, and the philosophy is simple: buy quality businesses and hold them for at least five years.

It’s not about trading or timing the market, but steadily building wealth over time.

Here’s what you get access to each month as a member:

- Two new stock picks

- A curated list of “Best Buys Now.”

- A set of Starter Stocks for building a solid portfolio foundation.

- Access to all past recommendations with performance data.

In short, Stock Advisor is a straightforward, research-driven newsletter for investors who want consistent, long-term stock ideas without doing all the legwork themselves.

(2) Who’s Behind Stock Advisor?

Stock Advisor is published by The Motley Fool, a company founded by brothers David and Tom Gardner. Over the past few decades, the Fool has built a reputation for making long-term investing accessible to everyday investors, and it has become one of the most recognized names in financial publishing.

Inside Stock Advisor, the Gardner brothers take slightly different approaches.

David Gardner is known for finding high-growth, innovative companies early, while Tom Gardner often focuses on more established businesses with durable advantages.

Together, their contrasting styles give members a blend of growth and stability. And I think this is one of the key things that makes Stock Advisor so unique.

Unlike some services where the experts stay in the background, the Gardners and their analyst team are highly visible. They regularly update members on how past picks are performing, explain why they’re making new recommendations, and invest in many of the same stocks themselves — giving the service added transparency and value to subscribers.

(3) Does Stock Advisor Have a Good Track Record?

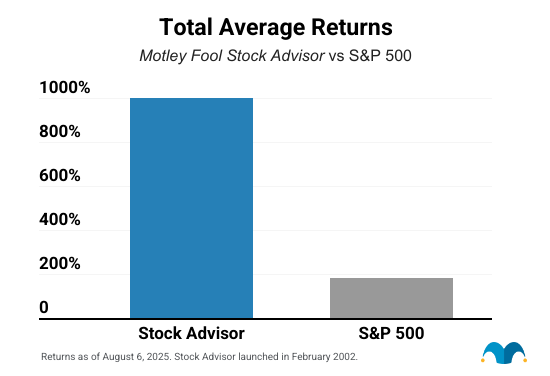

Yes, and it’s one of the main reasons the service has become so popular. Since launching in 2002, Motley Fool Stock Advisor’s recommendations have returned roughly 5–6 times the S&P 500 over the same period. Some of their most famous early calls include Amazon, Netflix, Disney, and Nvidia, recommended well before they became household names.

Not every pick has been a winner, but the idea is that a handful of big winners can (potentially) more than offset the losers if you follow their advice to hold 20+ stocks for at least five years.

Here’s how Stock Advisor’s average returns have compared to the S&P 500 (as of August 2025):

Independent audits and third-party reviews have confirmed this outperformance over extended periods, which is rare in the investment newsletter space. You also get access to all of their past recommendations in the member area, so you can verify it for yourself when you join.

(4) How Much Does Stock Advisor Cost?

Stock Advisor normally costs $199 a year, but right now, new members can join for just $99, a 50% discount that breaks down to just $1.90 a week.

==> Go here to get Stock Advisor for 50% off

There’s also a 30-day membership fee-back guarantee. So you can try the service and see if it’s a good fit. If you cancel in the first month, you’ll get a full refund of the membership fee.

Compared to other investing newsletters (many of which cost several hundred to thousands of dollars per year), Stock Advisor is one of the most affordable options.

They do offer higher-priced premium services, but Stock Advisor is the core product, and you don’t need to buy any upsells to get full value from it.

(5) Who Is Stock Advisor Best Suited For?

Stock Advisor is designed for long-term investors who want to build wealth steadily by owning quality businesses. If you’re comfortable buying stocks and holding them for at least five years, this service is a strong fit.

It works especially well for:

- Beginners who want a straightforward, proven way to start investing in individual stocks.

- Busy professionals who don’t have time to research dozens of companies but still want market-beating ideas.

- Investors looking for a mix of growth opportunities (like Amazon or Nvidia in their early days) alongside steadier, blue-chip picks.

On the other hand, Stock Advisor is not a good match for day traders, people expecting quick profits, or anyone unwilling to ride out short-term market volatility. The Motley Fool is very clear: even their best stock ideas can be volatile in the short run, and the strategy only works if you give it time.

In short, Stock Advisor is best for investors who want a reliable, long-term stock-picking service to help them grow their portfolio without getting caught up in the noise of daily market swings.

(6) Is Motley Fool Stock Advisor Legit?

Absolutely — yes, it is. Stock Advisor has been around since 2002, is backed by one of the most established names in financial publishing, and has a proven record of recommending stocks that went on to deliver huge returns. With more than half a million members, transparent performance tracking, and a solid refund policy, it’s as legitimate as investment newsletters get.

That said, like any stock-picking service, it’s not magic. Some recommendations don’t pan out, and success depends on building a diversified portfolio and holding for the long term.

So, while Motley Fool Stock Advisor is 100% legitimate, not every pick will be a home run.

It’s not my top recommendation, either.

If your goal is to position yourself for once-in-a-generation trends, and you want a service that blows everything else out of the water… there are better options to consider.

For example: Alexander Green.

I’ve reviewed hundreds of investment newsletters over the years, and few have impressed me as much as Alex Green’s track record.

He has called more triple-digit (and even quadruple-digit) stock winners than anyone I’ve seen. In fact, Alex identified 4 of the 6 best-performing stocks of the past 20 years — Apple, Netflix, Intuitive Surgical, and Nvidia.

That’s not just impressive — it’s nearly unheard of.

Now, Alex is zeroing in on what he sees as the biggest investment opportunity for 2025: artificial intelligence.

He believes AI is about to reshape the global economy, and that it could create 20 million new millionaires over the next four years as America races to lead the AI revolution.

In a brand-new presentation, Alex reveals his top 3 AI stocks for 2025 — and why each could soar as much as 20-fold or more in the years ahead.

He shares all the details in a special event alongside veteran broadcaster Bill O’Reilly.

Click here to watch the full presentation now:

Go Here to Watch the Presentation ►