Hello, and welcome to my review of Ian King’s Strategic Fortunes.

Ian King is a stock picker who claims to have a knack for spotting “tipping-point” trends — the kind of tech breakthroughs that can supposedly hand early investors massive gains.

Through his Strategic Fortunes service, he says he can help everyday folks tap into these opportunities before the rest of Wall Street catches on.

But let’s be honest…

The stock-picking world is packed with hype, bold promises, and plenty of marketing spin. That’s why taking the time to separate real research from clever sales tactics is so important.

In this review, I’ll share exactly what I uncovered about Ian King’s Strategic Fortunes, so you can decide if it’s worth your time (and money).

I’ll also introduce you to my top-rated newsletter, which is a no-hype service run by a guy who has called more triple-digit (and even quadruple-digit) stock winners than anyone I’ve seen.

See My Top-Rated NewsletterStrategic Fortunes Review: 6 Things to Know Before Joining

I’ve reviewed 100s of stock-picking services over the years, and in that time, I’ve learned that there are a handful of red flags to watch out for.

Knowing these can help you avoid scams and find legitimate services that (actually) help you outperform the market and secure your financial future.

(1) Does the Company Make “Get Rich Quick” Claims?

One of the most common signs of a newsletter scam is sensationalist claims about how you can make big money in a short period of time following the stock picker’s recommendations.

Anything is possible in the stock market, but overhyped marketing is a dead giveaway that you are dealing with a shady service because legitimate companies don’t do this. Instead, they share their (actual) research with you to help you understand their thesis.

In the end, if you think the presentation is using sensationalist marketing hype rather than sharing genuine investment research with you, think twice before joining it.

What does the company claim? Ian King definitely leans into bold claims. He often talks about uncovering big trends and helping you find “little-known” stocks poised for exponential gains before the mainstream catches on. He also talks a lot about how he’s found big tech winners in the past, but he doesn’t tell you that many of his picks have actually lost money, too.

(2) Does Strategic Fortunes Have a Good Track Record?

The best stock advisories have a proven track record of success because what they recommend has worked and has helped their subscribers grow their wealth.

In contrast, low-quality newsletter services don’t show you how well the service has performed because they know their picks haven’t worked out.

Some companies even hide their track records in the newsletter archives, where no one looks, which makes it virtually impossible to verify their complete track record.

If the company isn’t upfront about how it has performed… it’s probably one to avoid.

Does Strategic Fortunes have a good track record? Ian King has recommended some great stocks over the years, like Tesla, Palantir Technologies, and Micron Technology. However, he has also recommended his share of losing stocks, some of which have outright tanked.

For example, he recommended SunPower Corporation in 2020 (which is no longer publicly traded) and ESS Tech Inc. in 2023 (which has since experienced a significant drawdown).

He has also recommended numerous scammy crypto tokens (altcoins) over the years, most of which have likely tanked.

So I would recommend exercising caution before following his picks. Some of his recommendations have worked out well for subscribers, but many are highly speculative.

(3) Are There Any Hidden Fees?

Another thing to watch out for is companies with shady pricing policies.

For instance, some companies sell their service at a low price for the first 12 months, but then it automatically renews at a higher price after that, which isn’t properly disclosed.

If a company tries to charge you hidden fees and isn’t upfront about their pricing, that is a red flag and a warning sign to avoid getting involved with them.

How much does Strategic Fortunes cost? Strategic Fortunes costs $297 per year, or $49 for a 3-month membership. There are a few upsells as well:

- Strategic Fortunes Pro ($499/year)

- Next Wave Crypto Fortunes ($1,995/year)

- Extreme Fortunes ($1,995/year)

(4) Is the Refund Policy Legitimate?

Unethical stock advisory companies do not have clear, transparent refund policies in place for their services, which is another red flag to watch out for.

For example, some companies lead you to think they provide a money-back guarantee in the sales copy, but if you ever try to get your money back, you find out that all they really offer is a “credit refund.” What this means is that you can only get a ‘credit’ to use toward buying another one of their services. This is highly unethical because it means you can never truly get your money back.

Bottom line… genuine stock advisory companies provide genuine money-back guarantees on their services because they know what they’re offering provides real value. So if the company you are researching has a shady refund policy in place, it may be one to avoid.

Does Strategic Fortunes have a good refund policy? If you read the fine print, it appears that the company has a strict ‘no refunds’ policy in place. However, many of the promotions I’ve seen for Strategic Fortunes state that it has a 30-day refund policy, so it might pay to check before joining.

(5) Does the Company Have a Good Reputation?

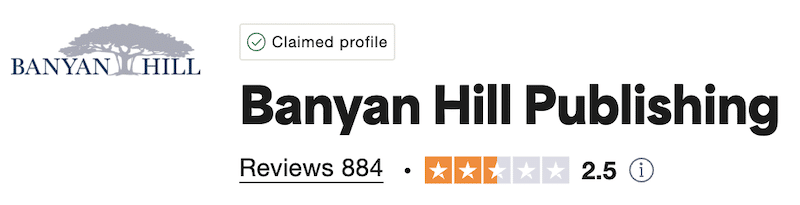

One thing I always do when researching a newsletter service is check the company’s TrustPilot rating, as this is one of the best places to go to find genuine customer reviews. If a company doesn’t have a TrustPilot profile or is rated below 4 stars, there are likely better alternatives to consider.

What is Strategic Fortunes’ TrustPilot rating? The company behind Ian King’s Strategic Fortunes service, Banyan Hill Publishing, currently has a 2.5-star TrustPilot rating:

(6) Is Strategic Fortunes Legit?

Strategic Fortunes isn’t a scam. It’s a real service that provides subscribers with genuine research and stock picks, some of which have done really well over the years.

That said, it’s not my top recommendation.

There’s often a lot of sensationalism in Ian King’s marketing, and despite the bold claims, I’m not convinced that it’s the best service out there.

So while it is a legitimate service, I wouldn’t recommend it, especially when I know there are far better options available.

For example: Alexander Green.

I’ve reviewed hundreds of investment newsletters over the years, and few have impressed me as much as Alex Green’s track record.

He has called more triple-digit (and even quadruple-digit) stock winners than anyone I’ve seen. In fact, Alex identified 4 of the 6 best-performing stocks of the past 20 years — Apple, Netflix, Intuitive Surgical, and Nvidia.

That’s not just impressive — it’s nearly unheard of.

Now, Alex is zeroing in on what he sees as the biggest investment opportunity for 2025: artificial intelligence.

He believes AI is about to reshape the global economy, and that it could create 20 million new millionaires over the next four years as America races to lead the AI revolution.

In a brand-new presentation, Alex reveals his top 3 AI stocks for 2025 — and why each could soar as much as 20-fold or more in the years ahead.

He shares all the details in a special event alongside veteran broadcaster Bill O’Reilly.

Click here to watch the full presentation now:

Go Here to Watch the Presentation ►